Installing a new hot water tank is a big home improvement that may make your daily life...

From the time a fighter shows up for their first training session until the thrilling finale of...

It is cheaper, more fun, and saves money to live with other students. It takes practice to...

Through its well-produced line of men’s perfumes, BYZA offers a sophisticated edge to modern masculinity. A man’s...

Balcony apartments that offer open-air space combined with urban convenience appeal to renters seeking a mix of...

There is more to maintaining your car than changing the oil and rotating the tires. One important...

Brazilian Jiu-Jitsu (BJJ) is commonly seen as a grappling and submission hold martial art or self-defence system....

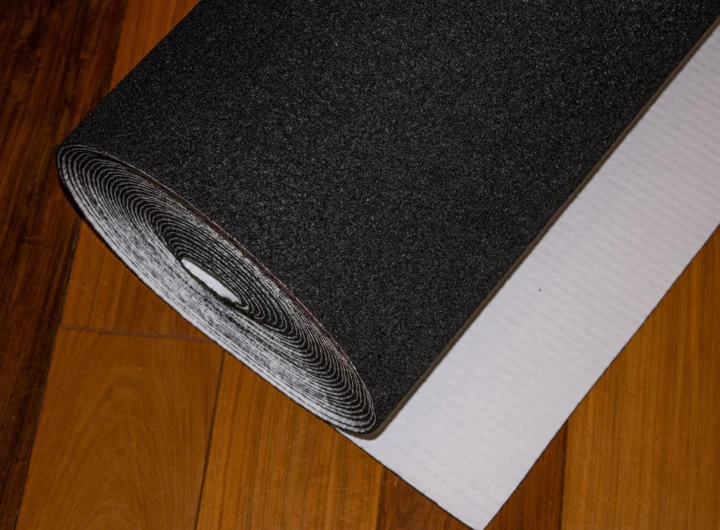

Do you find echo-filled corridors and noisy rooms to intolerable? With premium acoustic panels that not only...

Celebrated for its historic beauty, energetic culture, and breathtaking riverfront views, Heidelberg is a charming city tucked...

Keeping a septic system can be expensive if regular maintenance is neglected. The costs of emergency repairs,...

A place where every drill is made just for them and every game feels like an exciting...

Virtual staging lets sellers and managers make as many design changes as they want without having to...

Probate is the process by which someone’s estate is handled upon death. This legal procedure guarantees that...

Our team thinks that every kitchen should look beautiful for a long time. To make sure the...

Water getting into a home from a quick burst pipe, an appliance that overflows, or bad weather...

Businesses can always improve their website’s search engine score, but the ways they do this are always...

It might be difficult to keep your smile bright while wearing braces or other orthodontic devices. Around...

Things that happen before the first brick is laid can have a big impact on how the...

Many of us search for efficient means to optimize our effort and speed progress in pursuit of...

A well-kept fence not only improves the appearance of your property but also guarantees long-term durability and...

Key in enabling homeowners change their residences into modern living spaces is an electrical contractor. Using the...

Businesses must implement successful internet marketing plans if they are to survive in the competitive digital scene...

The holidays present chances for celebration, community, and lifetime memories. Every family has treasured rituals, whether it’s...

Finding the correct dentist for someone with special needs in New York City might prove difficult. For...

For homeowners, home security has always been a first concern; as technology develops, so do our means...

Custom concrete design has transformed how businesses and households improve their surroundings. Originally thought of as just...

When it comes to home or business improvement, few things make as noticeable an impact as a...

Many people use a living trust to handle their assets and be free from probate when making...

It is very competitive to be a dentist these days, so making sure people are happy and...

In handling an emergency, speed and efficiency are absolutely important. Regarding house maintenance, few situations are as...

When accuracy and a personal touch are combined with luxury, they create a special charm. Imagine going...

Regarding choosing a concrete company, a lot of false information might distort judgment and cause bad conclusions....

When things go wrong in a relationship, trust is often the first thing to be lost. It’s...

Modular homes have evolved from basic, reasonably priced housing options to opulent, very adjustable living environments in...

When your car breaks down, the last thing you want to do is go through the hassle...

Luxury is an experience, not only a term; high-end lodging and meals help make an average trip...

We are the go-to service for those who come across these strange and sometimes misunderstood snakes because...

In today’s financial nature, your credit report plays a crucial role in determining your financial opportunities, from...

Though it can be difficult to create the impression of space in a small area, any space...

Like any important asset, owning a boat is a large investment and needs appropriate maintenance to keep...

Getting stunning lashes has never been simpler, particularly with the correct direction to identify the perfect curl...

When we consider keeping our houses, the garage door usually goes underappreciated. But this key point of...

Moving to another house is a huge life altering situation that frequently accompanies its reasonable portion of...

Choosing a wedding photographer in Maui is a significant decision in the wedding planning process. The right...

Your house is perhaps of the main investment you’ll at any point make, and your roof is...

Writing essays is a common task for students, but it can sometimes be challenging and time-consuming. Fortunately,...

In the digital age, a website is often the first point of contact between a business and...

When there is something dangerous or inconvenient at home, this is where accessing an emergency gas engineer...

The allure of mastering the guitar has captivated aspiring musicians for generations. However, the traditional path to...

As you prepare to adorn your home with the dazzling brilliance of Star Shower Laser 9 Christmas...

Securing capital to pay launch costs, operations expenditures, and expansion ambitions is part of financing a small...

The online shopping landscape is constantly evolving, and staying updated with industry trends and customer preferences is...